Complication Insurance Advantages & Coverages in Turkey

Medical tourism has become a preferred option for thousands of international patients choosing Turkey for procedures such as hair transplantation, aesthetic surgery, dental treatments, orthopedics, and other planned medical interventions. While Turkey offers high-quality healthcare services at competitive costs, every medical procedure—no matter how routine—carries a certain level of risk. This is where Complication Insurance plays a critical role.

This comprehensive guide explains what complication insurance is, what it covers, its advantages for international patients, and why it has become an essential part of a safe and well-planned medical journey in Turkey.

What Is Complication Insurance?

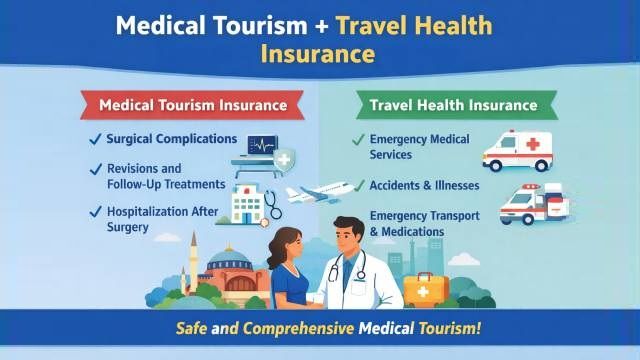

Complication Insurance is a specialized insurance product designed for patients who travel abroad for medical treatment. It provides financial protection against unexpected medical complications that may arise after a planned procedure.

Unlike standard travel health insurance, complication insurance specifically focuses on risks directly related to the medical intervention itself. If a complication occurs that requires additional treatment, hospitalization, revision surgery, or extended care, the insurance steps in to cover the related costs within the policy limits.

For international patients, this coverage offers peace of mind and financial security at a time when medical uncertainty can be stressful and costly.

Why Complication Insurance Is Important for Medical Tourists

Many patients assume that the initial treatment fee includes all potential outcomes. However, medical services are typically priced based on standard procedures without complications. If an unexpected situation arises, additional costs can occur quickly.

Complication insurance is important because it:

- Protects patients from unexpected medical expenses

- Eliminates financial disputes between patients and healthcare providers

- Ensures access to timely follow-up care

- Supports ethical and transparent medical tourism practices

In Turkey, where medical tourism volumes are high, complication insurance has become an increasingly recommended—and in some cases required—solution for international patients.

Key Advantages of Complication Insurance

1. Financial Protection

The most significant advantage of complication insurance is financial security. Post-operative complications may involve:

- Additional hospital stays

- Emergency interventions

- Revision or corrective surgeries

- Intensive care or specialized treatment

Without insurance, these costs can place a heavy burden on patients. Complication insurance ensures that such expenses are covered according to the policy terms.

2. Peace of Mind During Recovery

Recovering from a medical procedure abroad can already be challenging. Knowing that potential complications are insured allows patients to focus on healing rather than worrying about unexpected bills.

This peace of mind is especially valuable for patients who return to their home country shortly after treatment.

3. Continuity of Medical Care

If a complication develops after discharge, complication insurance helps ensure continuity of care. Patients can receive prompt treatment without delays caused by financial concerns.

In many cases, insurance coverage also facilitates coordination between healthcare providers and hospitals.

4. Transparent and Ethical Medical Tourism

Complication insurance supports trust between patients, clinics, and hospitals. It clearly defines responsibilities and coverage, reducing misunderstandings and protecting all parties involved.

For reputable providers in Turkey, offering complication insurance reflects professionalism and patient-centered care.

5. Affordable Premiums Compared to Potential Costs

When compared to the high costs of treating complications out-of-pocket, complication insurance premiums are relatively affordable. A small upfront investment can prevent significant financial loss later.

What Does Complication Insurance Cover?

Coverage may vary depending on the policy, but most complication insurance plans include the following:

Post-Operative Complications

Medical conditions directly related to the original procedure, such as:

- Infection

- Excessive bleeding

- Wound healing problems

- Anesthesia-related complications

Revision and Corrective Procedures

If the initial treatment results in a medical complication that requires a corrective or revision procedure, the insurance may cover:

- Surgeon fees

- Operating room costs

- Hospitalization expenses

Hospitalization and Medical Treatment

Coverage often includes:

- Inpatient and outpatient care

- Medications related to the complication

- Diagnostic tests and imaging

Emergency Medical Intervention

In cases where urgent medical attention is required due to a complication, insurance ensures fast access to emergency care without financial hesitation.

Follow-Up Care Within the Coverage Period

Many policies cover complications that occur within a defined period after the procedure (for example, 30, 60, or 90 days), ensuring protection beyond the initial treatment date.

What Is Usually Not Covered?

To avoid misunderstandings, patients should be aware of common exclusions, which may include:

- Pre-existing medical conditions

- Complications unrelated to the insured procedure

- Non-medical expenses (travel changes, accommodation, lost income)

- Treatments outside the policy scope or time limit

Reviewing policy terms carefully before purchase is essential.

Who Should Purchase Complication Insurance?

Complication insurance is strongly recommended for:

- International patients undergoing surgical or invasive procedures

- Patients traveling for aesthetic, dental, or hair transplant treatments

- Individuals seeking cost certainty during medical travel

- Patients who plan to return home shortly after treatment

Regardless of how routine a procedure may seem, complication insurance adds an important layer of protection.

Why Choose Online Complication Insurance in Turkey?

With digital platforms like saglikturizmisigortasi.com, patients can now purchase complication insurance online, quickly, and securely.

Online insurance solutions offer:

- Easy policy comparison

- Fast issuance before treatment

- Clear coverage details

- Multilingual support for international patients

This convenience makes it easier than ever to integrate insurance into medical travel planning.

Final Thoughts: A Smart Step for Safe Medical Travel

Complication insurance is no longer an optional extra—it is a smart and responsible choice for anyone considering medical treatment abroad. In Turkey, where medical tourism continues to grow rapidly, having the right insurance coverage ensures a safer, more transparent, and stress-free experience.

By protecting patients from unexpected risks, complication insurance supports better outcomes, stronger trust, and a smoother recovery journey. Before traveling for treatment, securing comprehensive complication insurance is one of the most valuable steps you can take for your health and financial well-being.

For more information and secure online coverage options, visit saglikturizmisigortasi.com and plan your medical journey with confidence.

You can purchase your mandatory complication / medical insurance for health tourism online, 24/7, quickly and easily in 3 steps through our website. Furthermore, you can make your payment securely using the 3D Secure system, regardless of whether you use domestic or foreign bank cards. You will receive your policy instantly via email with a digital signature (QR code). To understand our customer satisfaction, simply check our Google reviews. 😊 (5.0 / 5.0 Rating - 4,000 Reviews)

Saglikturizmisigortasi.com is the first B2B and B2C platform offering online Health Tourism Complication Insurance for institutions.

Prepare your online policy before your trip to Turkey and don't leave your health to chance!

TAGS: Health tourism complication insurance, Medical tourism insurance in Turkey, Complication insurance Turkey, Online health tourism insurance, Insurance for foreign patients

🌐 https://www.saglikturizmisigortasi.com

🏢 Nispetiye Mah. Gazi Güçnar Sok. No:4 Kat:4 Ofis No:10 Beşiktaş, İstanbul